In 2024, QuickBooks Online has undergone significant updates to enhance its invoice layout, catering to the needs of small and medium-sized businesses. These changes have made Quickbooks Online Invoice more efficient, customizable, and user-friendly. Below are the top 7 alterations to QuickBooks Online Invoice layout that businesses need to understand.

1. Enhanced Custom Fields for Detailed QuickBooks Online Invoice

Custom fields are a powerful new feature in QuickBooks Online Invoice, allowing users to add specific fields to their invoices to capture unique information relevant to their business needs. This enhancement means you can tailor invoices more precisely, including all necessary details without cluttering the layout.

Why It Matters:

- Improved Record-Keeping: Capture detailed information such as project codes, purchase order numbers, or custom notes directly on the Quickbooks Online Invoice.

- Enhanced Professionalism: Custom fields help capture all client-specific requirements, leading to better communication and satisfaction.

- Streamlined Operations: Businesses can reduce back-and-forth communications and potential errors by having all relevant details on the Qucibooks Online Invoice.

2. Expanded Payment Options for Faster Transactions

QuickBooks Online now offers a broader range of payment options, customers can pay invoices quickly and securely. The available payment methods include:

- Credit and Debit Cards: Simplifies transactions with widely accepted payment methods.

- ACH Transfers: Ideal for bank-to-bank transfers, reducing transaction fees.

- Digital Wallets (PayPal and Venmo): Provides customers with modern and convenient payment options.

Why It Matters:

- Improved Cash Flow: Faster payments mean improved cash flow, which is critical for business operations.

- Customer Convenience: Offering multiple payment options enhances the customer experience, leading to quicker payments and higher satisfaction.

- Reduced Administrative Work: Automated payment processing reduces the need for manual entry and follow-up on unpaid invoices.

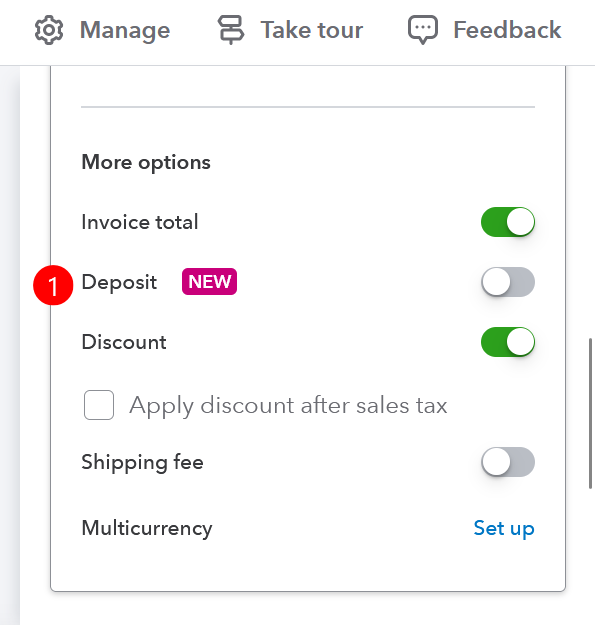

3. New Deposit Feature for Upfront Payments

One of the most significant updates is the deposit feature, which allows businesses to request and record deposits directly within an invoice. This feature is

handy for companies that require upfront payments before commencing work.

Why It Matters:

- Cash Flow Management: Ensures that businesses receive partial payment upfront, which is essential for managing cash flow, especially for large projects.=

- Clear Communication: The invoice clearly shows the deposit amount, total invoice amount, and outstanding balance, improving transparency with customers.

4. Simplified Invoice Layout and Design Improvements

QuickBooks Online has introduced a simplified invoice layout with better design customization options. Users can now create professional invoices that reflect their brand identity more effectively.

Why It Matters:

- Brand Consistency: Customizable templates allow businesses to maintain brand consistency across all communications.

- Professional Appearance: A clean and modern invoice design enhances the business’s professional appearance.

- Ease of Use: The intuitive design makes creating and managing invoices easier, reducing the time spent on administrative tasks.

5. Revenue Recognition and Flexible Scheduling

The update also includes advanced revenue recognition features in QuickBooks Online Advanced. Businesses should record revenue when earned to comply with accounting standards.

Why It Matters:

- Compliance: Ensures that businesses comply with revenue recognition standards (ASC 606), reducing the risk of non-compliance penalties.

- Efficiency: Automates the revenue recognition process, eliminating the need for manual tracking or third-party apps.

- Flexibility: Users can edit revenue recognition schedules, adjust pricing, and modify service dates, providing greater control over financial records.

6. Batch Reclassification of Transactions

QuickBooks Online now allows users to batch-reclassify transactions, significantly speeding up editing multiple transactions simultaneously.

Why It Matters:

- Time Savings: Batch reclassification reduces the time required to change multiple transactions, enhancing productivity.

- Accuracy: Ensures that financial records are accurate and up-to-date by allowing quick adjustments to transaction categories.

- Accessibility: Both business owners and accountants can access this tool, making it easier to manage financial records collaboratively.

7. Improved Invoice Tracking and Reporting

The new updates provide better tracking and reporting features for invoices, helping businesses monitor their financial health more effectively.

Why It Matters:

- Visibility: Enhanced tracking features provide visibility into unpaid, paid, and overdue invoices.

- Informed Decisions: Detailed reports on invoice statuses and payments help businesses make informed financial decisions.

- Automated Reminders: QuickBooks can automatically send reminders for upcoming or overdue invoices, ensuring timely payments.

For more detailed information on these updates, visit the QuickBooks official updates page or consult the user guides on their website. Stay ahead of the curve and make the most of these transformative changes to boost your business’s financial health.