Accounting Blog

Welcome to the Daniel Sandler CPA accounting blog—your friendly guide through the world of finance! Whether you’re a seasoned pro or just diving into the numbers, our blog is your go-to source for clear insights and practical advice. We’ve created a space where complex accounting topics are explained in straightforward terms, helping you make informed decisions with confidence. Explore our articles to uncover expert tips on everything from tax strategies to general accounting concepts. We’re here to empower you with knowledge that’s valuable and easy to apply in your everyday financial life.

- All Posts

- Advanced Accounting

- Industry Guide

- Learn Accounting

- Small Business Guide

- Software

- Tax

- Back

- Pets

- construction accounting

- Real Estate Rental

- Medical

- Childcare Business Accounting

- Food Truck

- Automotive Accounting

- Travel

- Nonprofit

- Grooming

- Electrical contractor accounting

- Back

- CPA Exam

- REG

- Back

- Electrical contractor accounting

- Back

- Grooming

- Back

- REG

Introduction to Depreciation Depreciation is a fundamental concept in accounting that pertains to the allocation of the cost of tangible...

Introduction to Plant Assets and GAAP In the realm of accounting, understanding the cost of plant assets is paramount, particularly...

Introduction In today’s fast-paced business environment, mobile payments have become an indispensable part of financial transactions. As more consumers prefer...

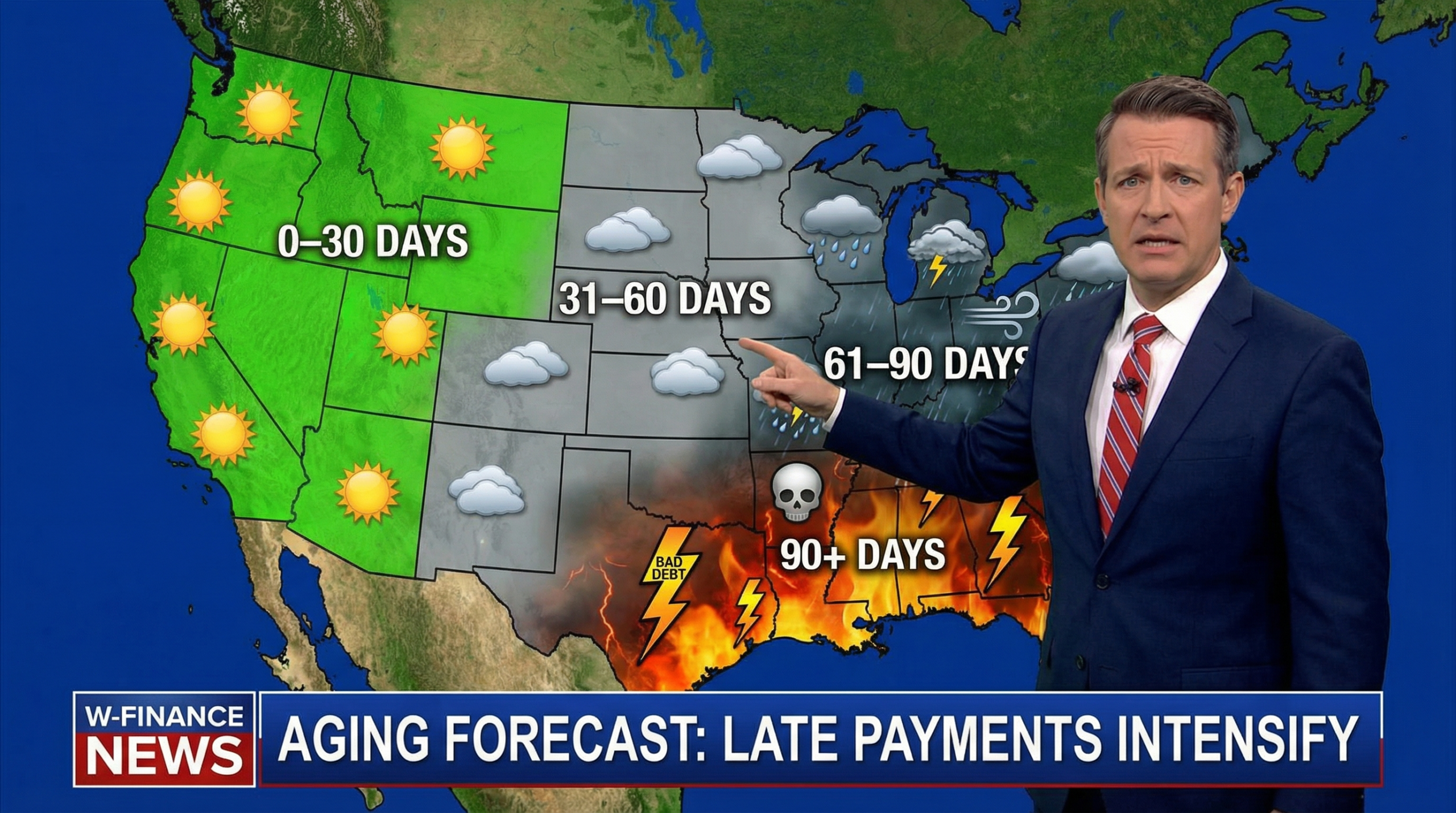

Introduction to Bad Debt Accounting Bad debt accounting refers to amounts owed to a business that are no longer deemed...

Mastering Cleaning Company Accounting Financial management is a critical aspect of running a successful cleaning business. Effective cleaning company accounting...

Introduction to Auto Repair Shop Accounting Running an auto repair shop involves not only a deep understanding of vehicles and...

Understanding FOB Shipping Point vs FOB Destination You’ve probably seen “FOB” on invoices and wondered what it means. FOB stands...

Introduction to Pet Grooming Business Financial Metrics In the competitive landscape of the pet grooming industry, understanding pet grooming business...

Introduction The field of accounting is not just about numbers; it is deeply intertwined with ethical decision making that affects...